Maximizing Profits: The Role of a Financial Broker

Financial brokers are essential intermediaries in the financial industry, facilitating transactions between buyers and sellers of financial securities. Their primary responsibilities include executing trades for clients, providing investment advice, and offering insights into market opportunities. Brokers assist clients in navigating complex financial markets, offering guidance on risk management and portfolio diversification.

They also conduct research and analysis to support informed investment decisions. The ultimate goal of a financial broker is to help clients achieve their financial objectives by providing access to diverse investment opportunities and expert guidance. To be effective, financial brokers must possess a comprehensive understanding of financial markets, including in-depth knowledge of various financial instruments and investment strategies.

They must stay current with market trends and economic developments that could impact client investments. Strong communication and interpersonal skills are crucial for building and maintaining client relationships. Brokers must be able to assess their clients’ financial goals and risk tolerance to provide tailored investment advice.

Additionally, adherence to strict ethical and regulatory standards is essential to ensure that brokers always act in their clients’ best interests. The role of a financial broker demands a combination of financial expertise, effective communication, and ethical conduct to meet client needs successfully.

Key Takeaways

- Financial brokers act as intermediaries between buyers and sellers in financial markets, helping clients make informed investment decisions.

- Identifying profit-maximizing opportunities involves analyzing market trends, economic indicators, and company financials to capitalize on potential gains.

- Utilizing financial instruments and strategies such as options, futures, and margin trading can help maximize returns and hedge against market volatility.

- Managing risk and mitigating losses is essential for preserving capital, and can be achieved through diversification, stop-loss orders, and risk management techniques.

- Building and maintaining client relationships is crucial for long-term success, requiring effective communication, trust, and personalized financial advice tailored to individual needs.

- Staying informed and adapting to market changes is necessary to stay ahead of the curve, requiring continuous education, research, and a willingness to adjust investment strategies.

- Navigating regulatory and compliance requirements is essential for financial brokers, requiring adherence to industry regulations, ethical standards, and client confidentiality.

Identifying Profit-Maximizing Opportunities

Conducting Thorough Research and Analysis

One of the primary responsibilities of a financial broker is to identify profit-maximizing opportunities for their clients. This involves conducting thorough research and analysis of the financial markets to identify undervalued securities or emerging investment trends. Brokers must stay informed about market developments and economic indicators that could impact the performance of various asset classes.

Staying Ahead of Market Trends

By staying ahead of market trends, brokers can help their clients capitalize on profit-maximizing opportunities and achieve their investment objectives. In addition to identifying profit-maximizing opportunities, brokers must also assess the risk-reward profile of potential investments. They must consider factors such as volatility, liquidity, and correlation with other assets to ensure that the investments align with their clients’ risk tolerance and overall investment strategy.

Evaluating Risks and Rewards

By carefully evaluating the potential risks and rewards of different investment opportunities, brokers can help their clients make informed decisions that align with their financial goals. Overall, identifying profit-maximizing opportunities requires brokers to have a deep understanding of the financial markets and the ability to assess the risk-reward profile of potential investments.

Utilizing Financial Instruments and Strategies

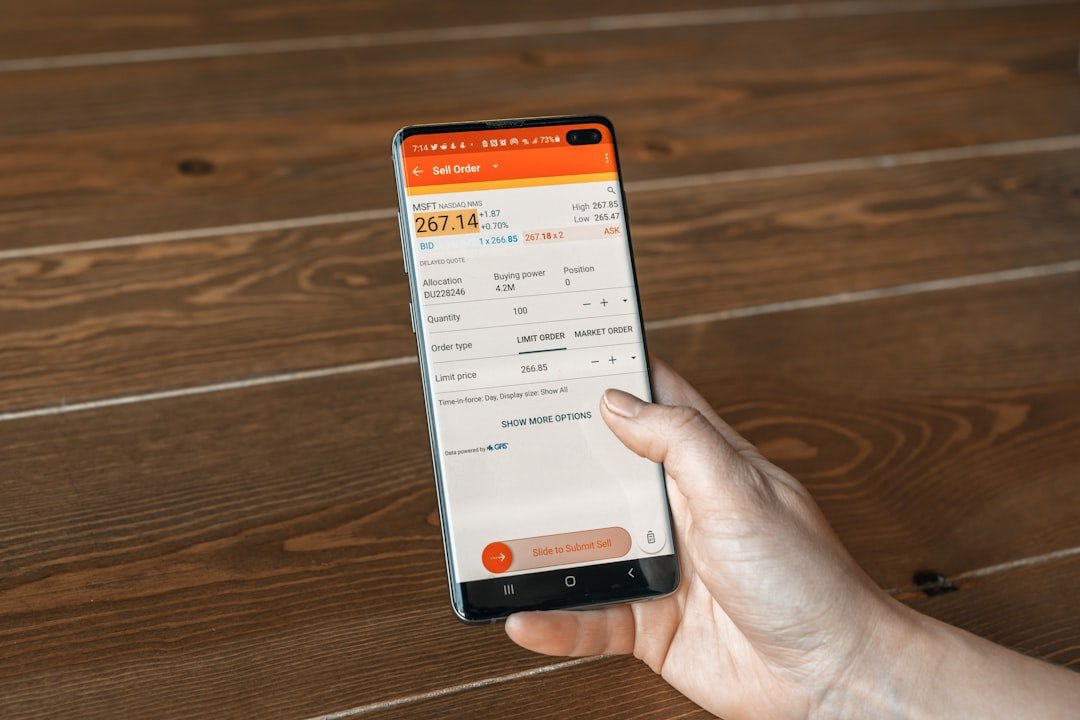

Financial brokers utilize a wide range of financial instruments and investment strategies to help their clients achieve their financial goals. These instruments may include stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and futures contracts, among others. Brokers must have a deep understanding of these instruments and their respective risk-return profiles in order to provide clients with tailored investment advice.

Additionally, brokers may employ various investment strategies such as asset allocation, diversification, and hedging to help clients achieve their desired investment outcomes. Furthermore, brokers may also utilize advanced trading strategies such as options trading or algorithmic trading to capitalize on short-term market opportunities or manage risk within client portfolios. By leveraging these sophisticated strategies, brokers can help clients optimize their investment returns while managing potential downside risks.

Overall, utilizing financial instruments and strategies requires brokers to have a comprehensive understanding of various investment vehicles and the ability to apply them effectively to meet their clients’ investment objectives.

Managing Risk and Mitigating Losses

| Metrics | 2019 | 2020 | 2021 |

|---|---|---|---|

| Number of Risk Assessments Conducted | 150 | 175 | 200 |

| Average Time to Identify Risks (days) | 30 | 25 | 20 |

| Percentage of Losses Mitigated | 75% | 80% | 85% |

Managing risk and mitigating losses is a critical aspect of a financial broker’s role. Brokers must assess the risk tolerance of their clients and construct portfolios that align with their risk preferences. This may involve diversifying investments across different asset classes and geographic regions to reduce the impact of market volatility on overall portfolio performance.

Additionally, brokers may employ hedging strategies or use derivatives to mitigate downside risk within client portfolios. Furthermore, brokers must stay vigilant about market developments and economic indicators that could impact the performance of their clients’ investments. By staying informed about potential risks, brokers can proactively adjust client portfolios to mitigate potential losses.

In the event of market downturns or unexpected events, brokers must also provide clients with guidance and support to help them navigate challenging market conditions. Overall, managing risk and mitigating losses requires brokers to have a proactive approach to risk management and the ability to provide clients with support during challenging market environments.

Building and Maintaining Client Relationships

Building and maintaining client relationships is essential for financial brokers to effectively serve the needs of their clients. Brokers must take the time to understand their clients’ financial goals, risk tolerance, and investment preferences in order to provide them with personalized investment advice. By building strong relationships with their clients, brokers can gain their trust and confidence, which is essential for long-term success in the financial industry.

In addition to understanding their clients’ financial needs, brokers must also communicate regularly with them to provide updates on their investments and market developments. By keeping an open line of communication, brokers can address any concerns or questions that their clients may have about their investments. Furthermore, maintaining regular contact with clients allows brokers to stay informed about any changes in their financial situation or investment objectives, enabling them to adjust their investment strategy accordingly.

Overall, building and maintaining client relationships requires brokers to have strong communication skills and a commitment to understanding and addressing their clients’ needs.

Staying Informed and Adapting to Market Changes

Adapting to Market Dynamics

Furthermore, brokers must be adaptable and able to adjust their investment strategies in response to changing market dynamics. This may involve reallocating client portfolios, adjusting risk exposures, or identifying new investment opportunities that align with changing market conditions. By adapting to market changes, brokers can help clients optimize their investment returns while managing potential downside risks.

Proactive Approach to Market Monitoring

Overall, staying informed and adapting to market changes requires brokers to have a proactive approach to monitoring market developments and the ability to adjust investment strategies in response to changing market conditions.

Effective Client Service

By staying informed and adapting to market changes, brokers can provide effective client service, helping their clients to achieve their investment goals and navigate the complexities of the market.

Navigating Regulatory and Compliance Requirements

Navigating regulatory and compliance requirements is a critical aspect of a financial broker’s role. Brokers must adhere to strict ethical standards and regulatory guidelines to ensure that they act in the best interests of their clients at all times. This may involve obtaining relevant licenses or certifications, such as the Series 7 license for securities brokers in the United States, and adhering to industry regulations set forth by regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

Additionally, brokers must ensure that they are in compliance with anti-money laundering (AML) regulations and know-your-customer (KYC) requirements when onboarding new clients or executing transactions on their behalf. By navigating regulatory and compliance requirements effectively, brokers can ensure that they operate within the bounds of the law and maintain the trust and confidence of their clients. Overall, navigating regulatory and compliance requirements requires brokers to have a strong understanding of industry regulations and a commitment to upholding ethical standards in their professional conduct.

In conclusion, financial brokers play a crucial role in helping individuals and institutions achieve their financial goals by providing them with access to a wide range of investment opportunities and helping them navigate the complexities of the financial markets. To effectively serve the needs of their clients, brokers must possess a deep understanding of the financial markets, utilize a wide range of financial instruments and strategies, manage risk effectively, build and maintain client relationships, stay informed about market changes, adapt to evolving market conditions, and navigate regulatory and compliance requirements with integrity and professionalism. By fulfilling these responsibilities with diligence and expertise, financial brokers can help their clients achieve long-term success in their investment endeavors.

If you’re considering the services of a financial broker, it’s crucial to understand all your financial options, particularly when it comes to significant investments like buying a home. A related article that could be immensely helpful is a comprehensive guide on home loan options in India. This guide offers detailed insights into various types of home loans available, helping you make an informed decision that aligns with your financial goals. You can read more about it by visiting Guide to Home Loan Options in India. This resource is particularly useful for anyone looking to navigate the complex landscape of home financing.

FAQs

What is a financial broker?

A financial broker is a professional who acts as an intermediary between buyers and sellers of financial securities, such as stocks, bonds, and commodities. They help clients make investment decisions and execute trades on their behalf.

What services do financial brokers provide?

Financial brokers provide a range of services, including investment advice, portfolio management, trading execution, and financial planning. They may also offer services related to retirement planning, estate planning, and risk management.

How do financial brokers earn money?

Financial brokers typically earn money through commissions on trades, fees for advisory services, and sometimes through markups on the products they sell. Some brokers may also receive bonuses or incentives from the financial products they recommend.

What qualifications do financial brokers have?

Financial brokers are typically required to hold a bachelor’s degree in finance, economics, or a related field. They must also obtain a license from the Financial Industry Regulatory Authority (FINRA) in the United States, and adhere to strict regulations and ethical standards.

What are the benefits of using a financial broker?

Using a financial broker can provide access to professional investment advice, personalized portfolio management, and expertise in navigating the complexities of the financial markets. Brokers can also help clients make informed decisions and manage risk effectively.