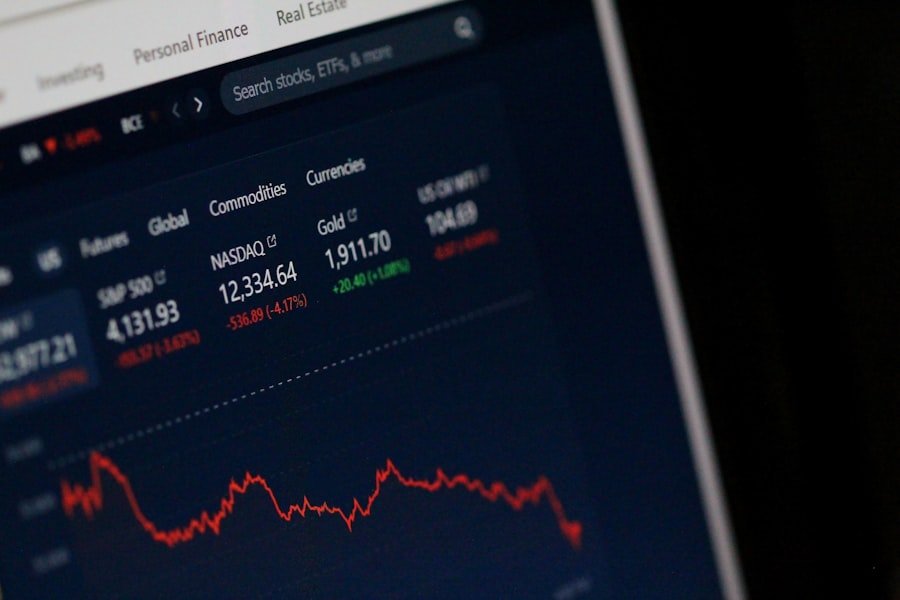

Yahoo, once a titan of the internet landscape, has undergone a remarkable transformation in recent years, culminating in a significant surge in its stock price. This resurgence is not merely a reflection of market trends but rather a complex interplay of strategic decisions, innovative ventures, and a renewed focus on core competencies. As investors and analysts closely monitor Yahoo’s performance, the stock price has become a focal point of discussion, symbolizing the company’s potential for growth and its ability to adapt to an ever-evolving digital environment.

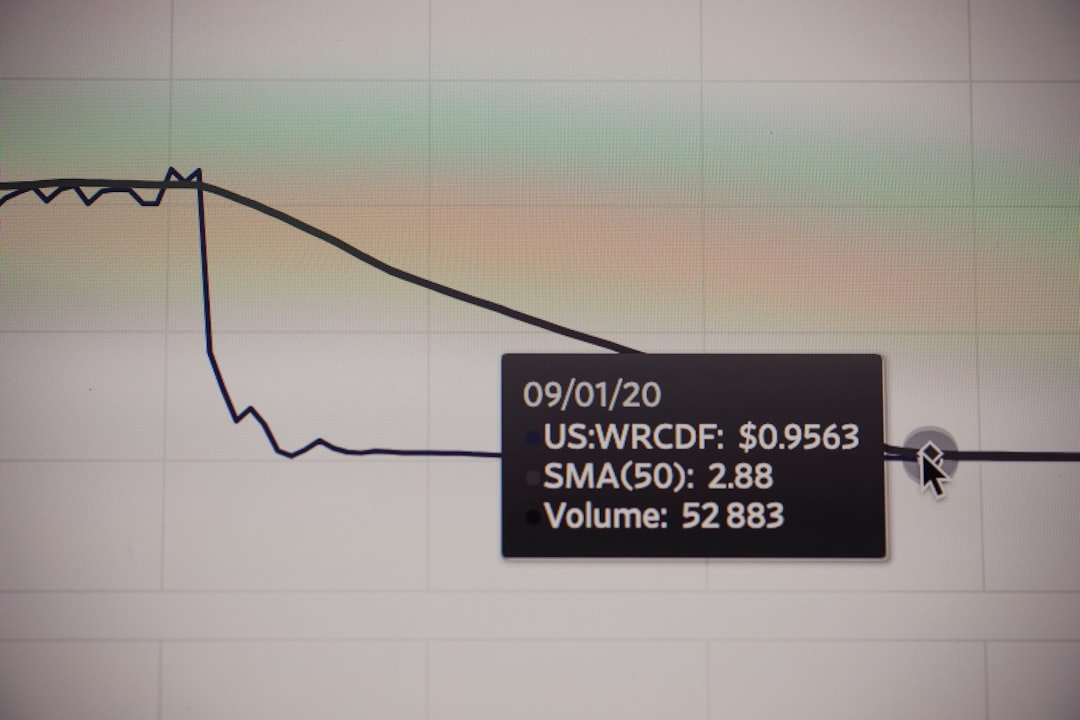

The fluctuations in Yahoo’s stock price serve as a barometer for investor sentiment and market confidence, making it essential to understand the underlying factors driving this change. The journey of Yahoo’s stock price is emblematic of the broader narrative surrounding technology companies in the 21st century. Once a leader in search engines and online services, Yahoo faced significant challenges as competitors like Google and Facebook emerged.

However, recent strategic pivots have positioned the company to reclaim its relevance in the tech sector. The stock price, which had languished for years, has begun to reflect these positive developments, drawing attention from both seasoned investors and newcomers alike. As we delve deeper into the factors contributing to this increase, it becomes clear that Yahoo’s stock price is not just a number; it represents a story of resilience, innovation, and the potential for future growth.

Key Takeaways

- Yahoo’s stock price has experienced a significant surge in recent months, attracting attention from investors and analysts alike.

- Factors contributing to the increase in Yahoo’s stock price include strong financial performance, strategic acquisitions, and positive market sentiment.

- When compared to its competitors, Yahoo’s stock price has outperformed many in the industry, positioning the company as a strong player in the market.

- The high stock price of Yahoo could have a potential impact on the market, influencing investor confidence and market trends.

- Analysis of Yahoo’s financial performance reveals a positive trajectory, with strong revenue growth and profitability driving the stock price surge.

Factors Contributing to the Increase in Yahoo’s Stock Price

Key Factors Behind Yahoo’s Stock Price Surge

Several key factors have contributed to the recent increase in Yahoo’s stock price, each playing a pivotal role in reshaping investor perceptions. One of the most significant drivers has been the company’s strategic focus on its core business areas, particularly digital advertising and content creation. By streamlining operations and divesting non-essential assets, Yahoo has been able to concentrate its resources on high-growth segments that promise better returns.

Renewed Focus on Core Business Areas

This renewed focus has not only improved operational efficiency but has also enhanced profitability margins, leading to increased investor confidence and a corresponding rise in stock prices. Moreover, Yahoo’s commitment to innovation has played a crucial role in its stock price resurgence. The company has invested heavily in technology and data analytics, enabling it to offer more targeted advertising solutions and personalized content to users.

Technological Advancements and Partnerships

This technological advancement has attracted advertisers looking for effective ways to reach their audiences, thereby boosting revenue streams. Additionally, partnerships with other tech giants and media companies have expanded Yahoo’s reach and influence in the digital space. As these initiatives begin to bear fruit, investors are responding positively, driving up the stock price as they anticipate sustained growth and profitability.

Investor Confidence and Future Growth

As a result, Yahoo’s stock price has experienced a significant surge, driven by the company’s strategic focus on core business areas, commitment to innovation, and expansion through partnerships. With these initiatives in place, investors are optimistic about the company’s future prospects, expecting sustained growth and profitability in the years to come.

Comparison of Yahoo’s Stock Price to Competitors

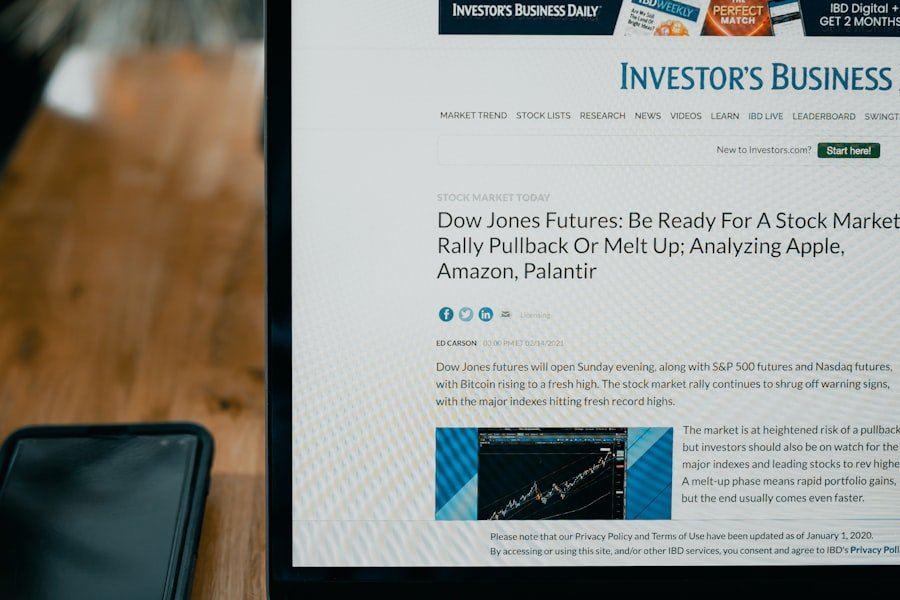

When evaluating Yahoo’s stock price trajectory, it is essential to place it within the context of its competitors in the tech industry. Companies like Google, Facebook, and Amazon have long dominated the market, often overshadowing Yahoo’s efforts. However, recent trends indicate that Yahoo is beginning to carve out its niche amidst this competitive landscape.

While Yahoo’s stock price may not yet rival that of its larger counterparts, the rate of growth it has experienced suggests a potential shift in market dynamics. Investors are increasingly recognizing that Yahoo’s strategic pivots could yield substantial returns, making it an attractive option compared to more established players. In contrast to its competitors, Yahoo’s stock price reflects a unique blend of risk and opportunity.

While Google and Facebook have consistently delivered robust financial results, their stock prices are often subject to volatility due to regulatory scrutiny and market saturation. Yahoo’s recent focus on niche markets and innovative advertising solutions positions it as a potential disruptor in the industry. This differentiation could lead to a more stable growth trajectory for Yahoo’s stock price as it capitalizes on emerging trends that larger companies may overlook.

As investors weigh these factors, Yahoo’s stock is increasingly viewed as a compelling alternative within the tech sector.

Potential Impact of Yahoo’s High Stock Price on the Market

| Metrics | Data |

|---|---|

| Yahoo’s Stock Price | High |

| Potential Impact | Increased market confidence |

| Market Reaction | Positive investor sentiment |

| Competitor Response | Pressure to match performance |

The implications of Yahoo’s rising stock price extend beyond the company itself; they resonate throughout the broader market landscape. A significant increase in Yahoo’s stock price can instill confidence among investors in the tech sector as a whole, signaling that even companies once considered laggards can rebound and thrive. This renewed optimism can lead to increased investment across similar firms, fostering an environment conducive to innovation and growth.

As investors seek out opportunities in companies that demonstrate resilience and adaptability, Yahoo’s success story may inspire others to pursue similar strategies. Furthermore, Yahoo’s high stock price could influence market dynamics by attracting attention from institutional investors who may have previously overlooked the company. As these investors enter the fray, they bring with them substantial capital that can further propel Yahoo’s growth initiatives.

This influx of investment can create a positive feedback loop: as Yahoo continues to innovate and expand its offerings, its stock price may rise even further, attracting more investors and solidifying its position in the market. In this way, Yahoo’s stock price serves not only as an indicator of its own health but also as a catalyst for broader market trends.

Analysis of Yahoo’s Financial Performance

A comprehensive analysis of Yahoo’s financial performance reveals a company that is not only recovering but also positioning itself for sustainable growth. Recent quarterly reports indicate an upward trajectory in revenue generation, driven primarily by improvements in digital advertising sales and content monetization strategies. The company’s ability to adapt to changing consumer preferences has allowed it to capture market share from competitors while simultaneously enhancing its profitability margins.

This financial resilience is reflected in key metrics such as earnings per share (EPS) and return on equity (ROE), both of which have shown marked improvement over recent reporting periods. Moreover, Yahoo’s prudent management of expenses has contributed significantly to its financial health. By focusing on operational efficiency and reducing overhead costs, the company has been able to allocate resources more effectively toward growth initiatives.

This disciplined approach not only bolsters profitability but also instills confidence among investors regarding future performance. As analysts scrutinize these financial indicators, it becomes evident that Yahoo is not merely riding a wave of market sentiment; it is laying the groundwork for long-term success through strategic planning and execution.

Expert Opinions on Yahoo’s Stock Price Surge

Yahoo’s Stock Price Surge: A Reflection of Strategic Pivots

The recent surge in Yahoo’s stock price has garnered attention from financial analysts and industry experts alike, many of whom view this trend as indicative of broader shifts within the tech sector. Experts highlight that Yahoo’s strategic pivots—particularly its focus on digital advertising and content creation—are well-aligned with current market demands. Analysts suggest that this alignment positions Yahoo favorably against competitors who may be struggling with regulatory challenges or market saturation.

Sound Business Practices and Sustained Growth

Many experts believe that Yahoo’s stock price surge is not merely a fleeting trend but rather a reflection of sound business practices that could lead to sustained growth. Additionally, expert opinions emphasize the importance of innovation in driving Yahoo’s recent success. Analysts point out that the company’s investments in technology and data analytics have enabled it to offer more personalized experiences for users while simultaneously attracting advertisers seeking effective marketing solutions.

A Dual Focus on User Engagement and Advertiser Satisfaction

This dual focus on user engagement and advertiser satisfaction is seen as a critical factor in bolstering investor confidence. By prioritizing both aspects, Yahoo has been able to create a win-win situation that benefits both its users and advertisers. As a result, the company has been able to differentiate itself from its competitors and establish a strong foundation for long-term success.

A New Era for Yahoo

As experts continue to monitor these developments, there is a growing consensus that Yahoo’s stock price surge may signal a new era for the company—one characterized by resilience, adaptability, and potential for long-term success. With its strategic pivots and focus on innovation, Yahoo appears to be well-positioned to navigate the ever-changing tech landscape and capitalize on emerging opportunities.

Future Outlook for Yahoo’s Stock Price

Looking ahead, the future outlook for Yahoo’s stock price appears promising, contingent upon several key factors that could influence its trajectory. Analysts predict that if the company maintains its current strategic focus on digital advertising and content creation while continuing to innovate technologically, it could see sustained growth in both revenue and stock value. The ongoing evolution of consumer behavior towards digital platforms presents an opportunity for Yahoo to capitalize on emerging trends and expand its market share further.

If executed effectively, these strategies could solidify Yahoo’s position as a formidable player within the tech industry. However, challenges remain on the horizon that could impact Yahoo’s stock price trajectory. Market volatility, regulatory scrutiny, and competition from larger tech firms are all factors that could pose risks to sustained growth.

Investors will need to remain vigilant as they assess how well Yahoo navigates these challenges while continuing to execute its strategic vision. Ultimately, while there are uncertainties ahead, the combination of strong financial performance, innovative initiatives, and expert endorsements suggests that Yahoo’s stock price may continue on an upward trajectory—reflecting not just recovery but also potential for future expansion within an ever-evolving digital landscape.

For those interested in the financial markets and investment opportunities, understanding the fluctuations in stock prices such as Yahoo’s can be crucial. While the specific dynamics of Yahoo’s stock price involve a variety of factors, including market trends and company performance, it’s also beneficial to explore related financial tools and resources. For instance, new authors looking to self-publish might consider the financial aspects of publishing and selling books as part of their overall investment strategy. A useful resource in this context could be exploring platforms like Barnes and Noble Press, which is detailed in a related article. You can read more about it and gain insights into self-publishing by visiting Navigating Barnes and Noble Press for New Authors.

FAQs

What is the current stock price of Yahoo?

The current stock price of Yahoo can be found by checking financial news websites, stock market apps, or by searching “Yahoo stock price” on a search engine.

Where can I find historical stock prices for Yahoo?

Historical stock prices for Yahoo can be found on financial websites such as Yahoo Finance, Google Finance, or through stock market data providers.

What factors can influence the stock price of Yahoo?

Factors that can influence the stock price of Yahoo include company performance, industry trends, economic conditions, changes in leadership, and market sentiment.

Is it a good time to invest in Yahoo stock?

The decision to invest in Yahoo stock should be based on thorough research, including analysis of the company’s financial health, industry outlook, and market conditions. It is recommended to consult with a financial advisor before making any investment decisions.

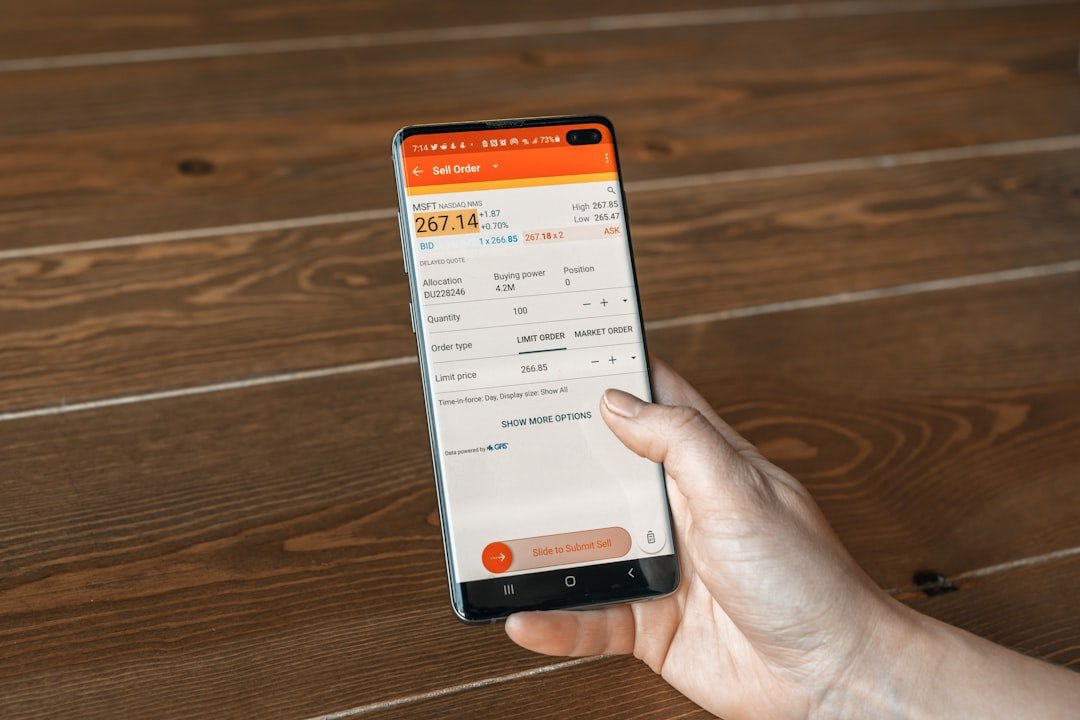

How can I track Yahoo stock price in real-time?

Yahoo stock price can be tracked in real-time through stock market apps, financial news websites, and by using stock market data providers that offer real-time quotes.

What is the stock symbol for Yahoo?

The stock symbol for Yahoo is “YHOO.” However, it is important to note that Yahoo has undergone changes and is now part of Verizon Communications Inc. under the stock symbol “VZ.”