Leveraged finance is a financial strategy that involves using borrowed funds to increase the potential return on investment. This approach is widely used in corporate finance, private equity, and investment banking to fund various strategic initiatives, including acquisitions and mergers. The primary goal of leveraged finance is to enhance returns on equity by utilizing a combination of debt and equity in the capital structure.

Common forms of debt used in leveraged finance include bank loans, high-yield bonds, and mezzanine financing. These financial instruments allow companies to access capital for operations, expansion, or other strategic purposes. While leveraged finance can significantly amplify potential returns, it also increases the associated risks, making it a double-edged sword for businesses seeking growth opportunities.

In personal finance, leveraged finance principles are applied when individuals use borrowed funds to make investments, such as taking out a mortgage to purchase a home or obtaining a loan to invest in a business venture. This approach enables individuals to make larger investments than they could with their own capital alone. However, it also exposes them to greater financial risk if the investment underperforms.

Understanding leveraged finance is essential for both companies and individuals making strategic financial decisions. It requires careful consideration of the potential benefits and risks associated with using borrowed funds to enhance investment returns. Proper management of leveraged finance strategies can lead to significant growth and financial success, while mismanagement can result in severe financial difficulties.

Key Takeaways

- Leveraged finance involves using borrowed money to increase the potential return of an investment

- The benefits of leveraged finance include increased potential returns, tax advantages, and the ability to fund growth without diluting ownership

- Leveraged finance strategies for growth include acquisitions, recapitalizations, and refinancing existing debt

- Risks and challenges of leveraged finance include increased financial risk, potential for default, and higher interest costs

- Leveraged finance is used in various industries such as healthcare, technology, and real estate

- Leveraged finance in a post-pandemic economy may require careful risk assessment and strategic planning

- Tips for successful implementation of leveraged finance include thorough due diligence, conservative financial projections, and maintaining a strong relationship with lenders

The Benefits of Leveraged Finance

Amplifying Returns

By using borrowed funds to finance a portion of an investment, companies can increase their return on equity and potentially generate higher profits than if they had used only their own capital. This can be particularly advantageous for companies looking to fund strategic initiatives such as acquisitions, mergers, or expansion projects.

Financial Flexibility and Tax Advantages

Leveraged finance can also provide companies with greater financial flexibility, allowing them to pursue growth opportunities that may not have been possible with only their own capital. Another benefit of leveraged finance is the potential tax advantages it can offer. Interest payments on debt are typically tax-deductible, which can lower a company’s overall tax liability and improve its cash flow.

Access to a Wider Range of Financing Options

This can make leveraged finance an attractive option for companies looking to optimize their capital structure and minimize their tax burden. Additionally, leveraged finance can provide companies with access to a wider range of financing options, including bank loans, high-yield bonds, and mezzanine financing, which can be tailored to meet their specific needs and objectives.

Leveraged Finance Strategies for Growth

There are several strategies that companies can use to leverage finance for growth and expansion. One common strategy is to use leveraged finance to fund acquisitions and mergers. By using borrowed funds to finance a portion of the purchase price, companies can expand their operations and market share without having to use all of their own capital.

This can allow companies to achieve economies of scale, diversify their product offerings, and enter new markets more quickly and efficiently. Another strategy is to use leveraged finance to fund organic growth initiatives such as new product development, research and development, and marketing campaigns. By using borrowed funds to finance these initiatives, companies can accelerate their growth and gain a competitive advantage in their industry.

Leveraged finance can also be used to fund capital expenditures such as new equipment, facilities, and technology upgrades, which can improve a company’s operational efficiency and productivity.

Risks and Challenges of Leveraged Finance

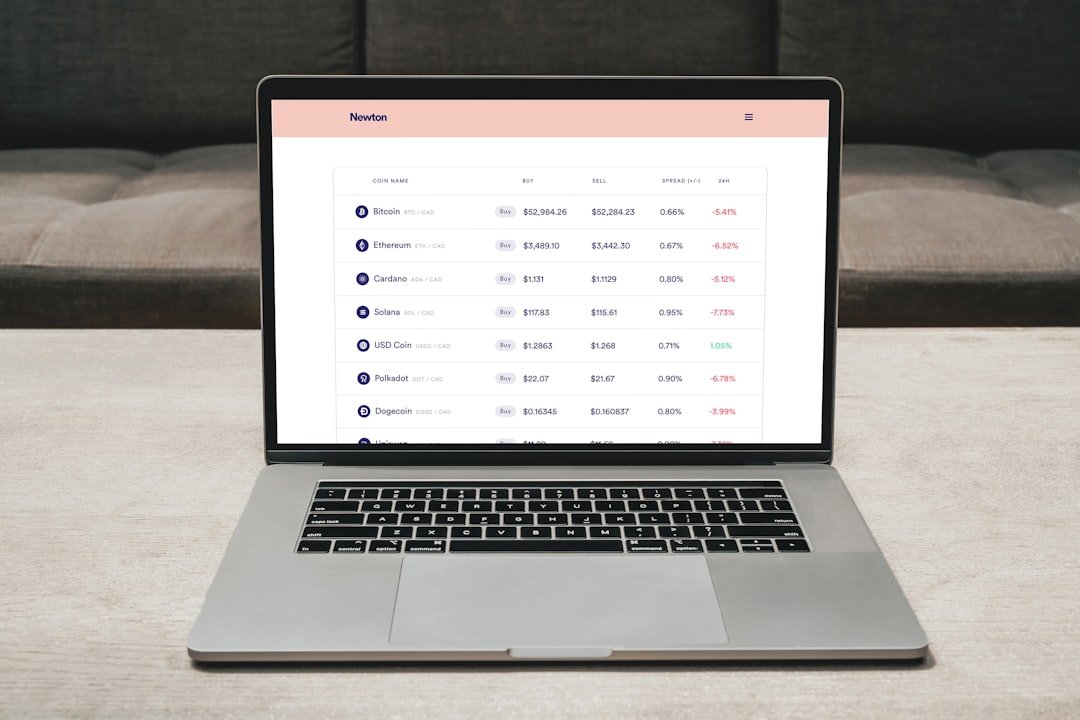

| Category | Risks and Challenges |

|---|---|

| Leverage | High levels of debt can increase the risk of financial distress and default. |

| Market Volatility | Fluctuations in interest rates and market conditions can impact the cost of borrowing and the value of leveraged assets. |

| Regulatory Changes | Changes in regulations can affect the ability to access leverage and the cost of compliance. |

| Default Risk | There is a higher risk of default for leveraged companies, especially during economic downturns. |

| Operational Challenges | Managing high levels of debt and financial complexity can pose operational challenges for leveraged companies. |

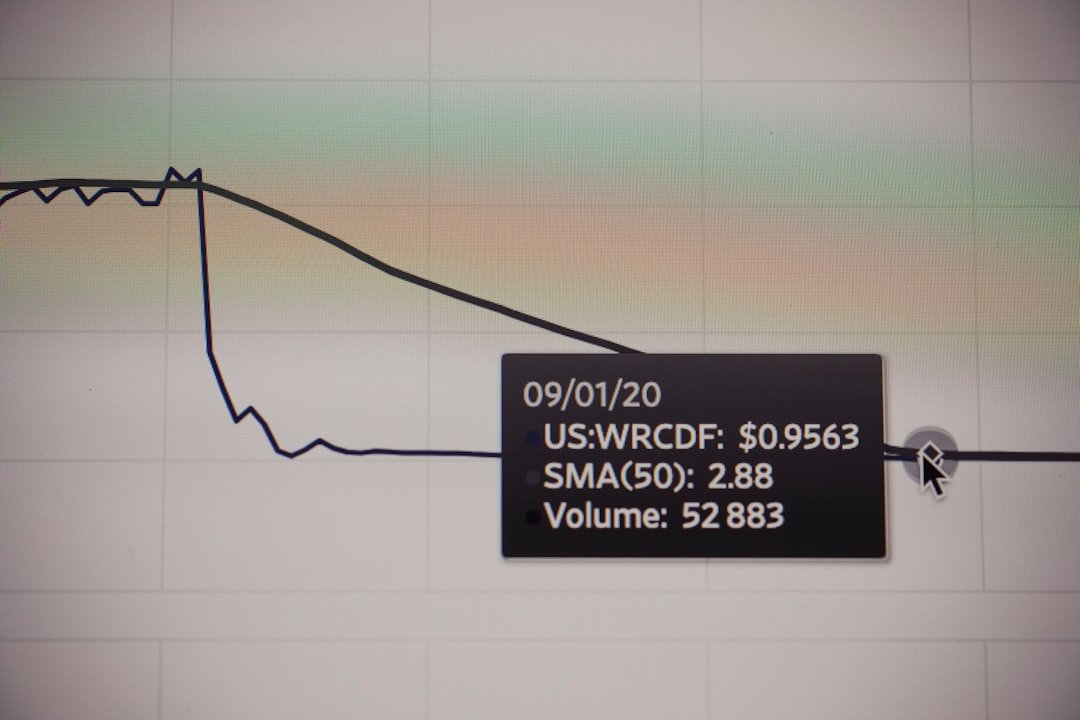

While leveraged finance offers many potential benefits, it also comes with significant risks and challenges that companies must carefully consider. One of the primary risks of leveraged finance is the increased financial leverage it creates. This can amplify both the potential returns and risks associated with an investment, making it crucial for companies to carefully assess their risk tolerance and financial stability before pursuing leveraged finance strategies.

High levels of leverage can also make a company more vulnerable to economic downturns, interest rate fluctuations, and other external factors that can impact its financial performance. Another challenge of leveraged finance is the increased financial obligations it creates. Companies that use leveraged finance must make regular interest payments on their debt, which can strain their cash flow and limit their financial flexibility.

Additionally, companies that are highly leveraged may find it more difficult and expensive to access additional financing in the future, which can hinder their ability to pursue future growth opportunities. It is important for companies to carefully manage their debt levels and maintain a strong balance sheet to mitigate these risks and challenges.

Leveraged Finance in Different Industries

Leveraged finance is used across a wide range of industries to fund various strategic initiatives and growth opportunities. In the technology industry, for example, leveraged finance is commonly used to fund acquisitions, research and development projects, and expansion into new markets. This allows technology companies to stay competitive in a rapidly evolving industry and capitalize on emerging trends and opportunities.

In the healthcare industry, leveraged finance is often used to fund mergers and acquisitions, capital expenditures, and new product development initiatives. This allows healthcare companies to expand their service offerings, improve patient care, and drive innovation in a highly regulated and competitive industry. In the consumer goods industry, leveraged finance is frequently used to fund marketing campaigns, product launches, and international expansion efforts.

This allows consumer goods companies to build brand awareness, drive sales growth, and capture market share in an increasingly global marketplace.

Leveraged Finance in a Post-Pandemic Economy

Consolidation and Expansion

Leveraged finance can be utilized to fund acquisitions and mergers, enabling companies to consolidate their operations, achieve cost synergies, and expand their market presence.

Strategic Initiatives

Furthermore, leveraged finance can be employed to fund strategic initiatives such as digital transformation projects, supply chain optimization efforts, and sustainability initiatives. These initiatives help companies adapt to the changing business landscape and capitalize on emerging trends.

Financial Flexibility and Long-term Success

Additionally, leveraged finance provides companies with the financial flexibility they need to navigate uncertain economic conditions and position themselves for long-term success.

Tips for Successful Implementation of Leveraged Finance

Successfully implementing leveraged finance requires careful planning, analysis, and execution. Companies should carefully assess their financial objectives, risk tolerance, and capital structure before pursuing leveraged finance strategies. It is important for companies to work closely with experienced financial advisors, investment bankers, and legal counsel to structure their leveraged finance transactions in a way that aligns with their long-term goals and objectives.

Companies should also conduct thorough due diligence on potential investment opportunities and financing options to ensure they are making informed decisions that align with their strategic priorities. It is crucial for companies to carefully manage their debt levels, monitor their financial performance, and maintain open lines of communication with their lenders and investors to mitigate the risks associated with leveraged finance. In conclusion, leveraged finance offers many potential benefits for companies looking to grow and expand their operations.

However, it also comes with significant risks and challenges that must be carefully managed. By understanding the principles of leveraged finance, carefully assessing their financial objectives and risk tolerance, and working closely with experienced advisors, companies can successfully implement leveraged finance strategies that position them for long-term success in a post-pandemic economy.

If you’re interested in learning more about leveraged finance, you may also want to check out this article on mastering SEO tools for online success. Understanding search engine optimization can be crucial for businesses looking to attract investors and secure financing.

FAQs

What is leveraged finance?

Leveraged finance refers to the use of debt to finance the acquisition of a company or to fund corporate operations. It typically involves high levels of debt relative to equity and is often used in leveraged buyouts and mergers and acquisitions.

How does leveraged finance work?

In leveraged finance, a company borrows money to fund its operations or to make acquisitions. This debt is often secured by the company’s assets and is repaid using the company’s cash flow. The use of leverage can amplify returns for investors, but it also increases the risk of financial distress.

What are the key players in leveraged finance?

The key players in leveraged finance include private equity firms, investment banks, commercial banks, and institutional investors such as hedge funds and pension funds. These entities provide the debt and equity financing needed for leveraged transactions.

What are the risks associated with leveraged finance?

The main risks associated with leveraged finance include the potential for financial distress if the company is unable to meet its debt obligations, the risk of default on the debt, and the potential for a decline in the value of the company’s assets. Additionally, leveraged finance transactions are sensitive to changes in interest rates and economic conditions.

What are the benefits of leveraged finance?

Leveraged finance can provide companies with the capital needed to grow and expand their operations, make strategic acquisitions, or restructure their balance sheets. It can also provide investors with the opportunity to earn higher returns than they might achieve through traditional equity investments.