Setting clear financial goals is essential for developing a successful investment portfolio. These goals should be specific, measurable, and aligned with your personal circumstances, such as saving for retirement, purchasing a home, or funding education. When establishing financial objectives, it’s crucial to consider your current financial status, risk tolerance, and investment time horizon.

Younger investors with longer time horizons may be more inclined to accept higher-risk investments for potentially greater returns. Conversely, those nearing retirement might prioritize more conservative investments to safeguard their savings. By defining clear financial goals, investors can tailor their strategies to meet their individual needs and objectives.

Clear financial goals also facilitate progress tracking and allow for necessary adjustments. Breaking long-term objectives into smaller, achievable milestones can help maintain focus and provide motivation through incremental successes. This approach can be particularly beneficial during periods of market volatility or economic uncertainty.

Furthermore, well-defined financial goals can prevent impulsive investment decisions based on short-term market fluctuations. Instead, investors can remain focused on their long-term objectives and make informed decisions that align with their overall financial plan. This disciplined approach helps maintain consistency in investment strategies and supports the achievement of long-term financial goals.

Key Takeaways

- Setting clear financial goals is essential for creating a roadmap to achieve your desired financial outcomes.

- Diversifying your investment portfolio can help spread risk and maximize potential returns.

- Researching and understanding investment options is crucial for making informed decisions and minimizing potential losses.

- Seeking professional financial advice can provide valuable insights and guidance for making sound investment choices.

- Being patient and avoiding impulsive decisions can help prevent emotional reactions that may negatively impact your investments.

Diversifying Your Investment Portfolio

Risk Management and Protection

Diversification can help shield your portfolio from significant losses by reducing the impact of any single investment underperforming. By investing in a mix of assets, you can mitigate downside risk and protect your portfolio during market downturns and economic recessions.

Opportunities for Growth and Income

Diversification can also provide opportunities for growth and income in various market conditions. For example, while stocks may offer the potential for high returns, bonds can provide stability and income during volatile market periods. Moreover, diversifying your investment portfolio can also help you take advantage of different investment opportunities and trends.

Aligning Investments with Your Goals and Risk Tolerance

By diversifying your investment portfolio, you can align your investments with your risk tolerance and time horizon. For example, if you have a low risk tolerance, you may want to allocate a larger portion of your portfolio to more conservative investments, such as bonds or cash equivalents. On the other hand, if you have a longer time horizon and higher risk tolerance, you may be comfortable allocating a larger portion of your portfolio to equities for potential long-term growth.

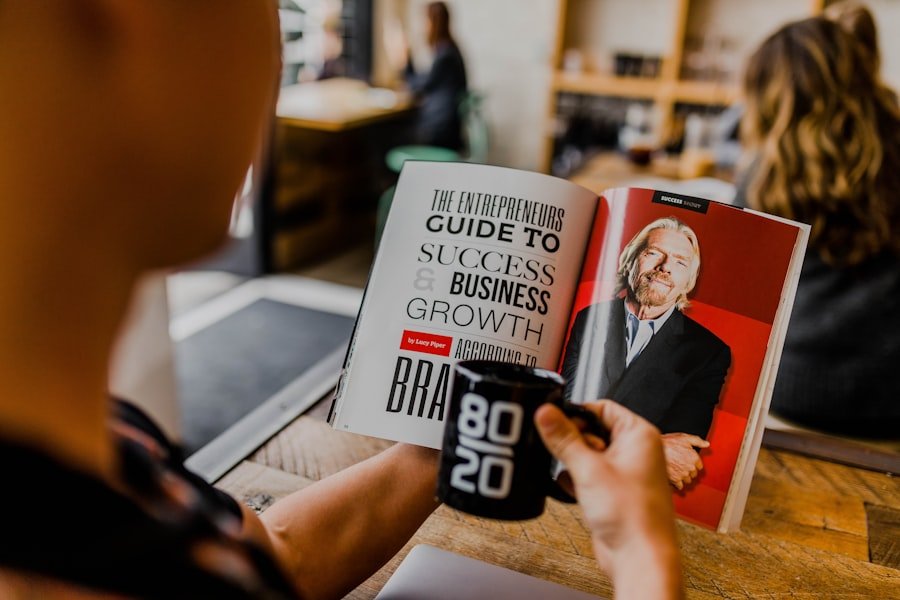

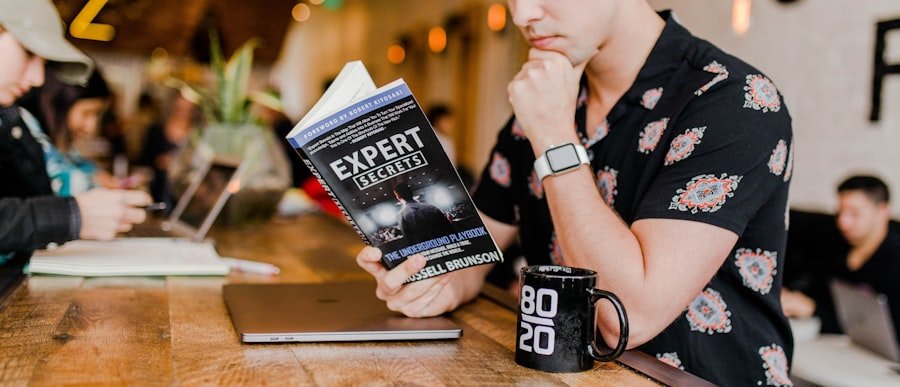

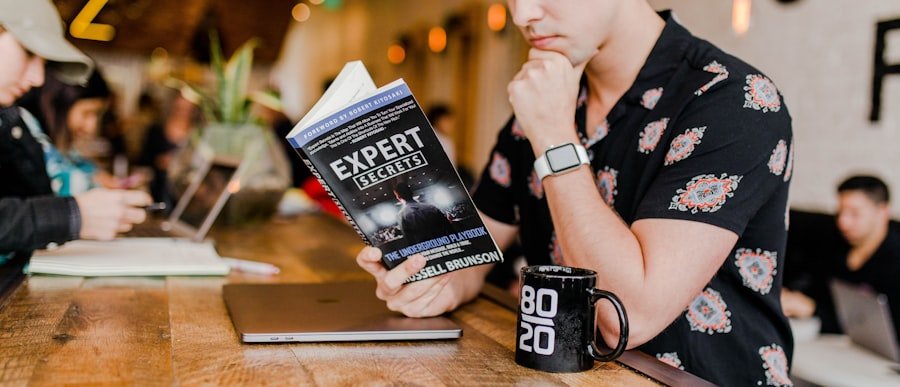

Researching and Understanding Investment Options

Researching and understanding investment options is essential for making informed investment decisions. With a wide range of investment options available, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and alternative investments, it’s important to conduct thorough research to identify the best opportunities for your portfolio. This may involve analyzing historical performance, evaluating risk factors, and understanding the potential impact of economic and market trends on different investment options.

By conducting comprehensive research, you can gain valuable insights into the potential risks and rewards of each investment option and make informed decisions that align with your financial goals and risk tolerance. Furthermore, understanding investment options can also help you build a well-diversified portfolio that meets your specific needs and objectives. For example, if you are seeking income and stability, you may want to consider investing in dividend-paying stocks or bonds.

On the other hand, if you are looking for long-term growth potential, you may want to explore opportunities in emerging markets or technology companies. By understanding the characteristics and potential returns of different investment options, you can tailor your portfolio to meet your specific investment objectives while managing risk effectively.

Seeking Professional Financial Advice

| Age Group | Percentage Seeking Professional Financial Advice |

|---|---|

| 18-29 | 25% |

| 30-44 | 40% |

| 45-59 | 55% |

| 60 and above | 65% |

Seeking professional financial advice can provide valuable guidance and expertise to help you make informed investment decisions. A qualified financial advisor can help you assess your current financial situation, identify your long-term goals, and develop a personalized investment strategy that aligns with your needs and objectives. Additionally, a financial advisor can provide ongoing support and guidance to help you navigate changing market conditions and economic trends.

This can be particularly valuable during periods of market volatility or economic uncertainty when emotions may drive impulsive investment decisions. Moreover, a financial advisor can also provide access to a wide range of investment options and opportunities that may not be readily available to individual investors. This can help you build a well-diversified portfolio that meets your specific needs and objectives while maximizing potential returns.

Additionally, a financial advisor can provide valuable insights into tax-efficient investment strategies, retirement planning, estate planning, and other important financial considerations. By seeking professional financial advice, you can gain access to expertise and resources that can help you build a successful investment portfolio and achieve your long-term financial goals.

Being Patient and Avoiding Impulsive Decisions

Being patient and avoiding impulsive decisions is essential for building a successful investment portfolio. While it can be tempting to react to short-term market fluctuations or economic news, making impulsive investment decisions can lead to poor outcomes and hinder long-term success. Instead, it’s important to stay focused on your long-term financial goals and maintain a disciplined approach to investing.

This may involve staying committed to your investment strategy during periods of market volatility or economic uncertainty and avoiding knee-jerk reactions based on short-term events. Furthermore, being patient can also help you take advantage of long-term investment opportunities and trends. By maintaining a long-term perspective and avoiding impulsive decisions, you can benefit from the potential growth of your investments over time.

This can help you achieve your financial goals and build wealth steadily while managing risk effectively. Additionally, being patient can also help you avoid unnecessary trading costs and taxes associated with frequent buying and selling of investments. By staying patient and disciplined in your investment approach, you can position yourself for long-term success and avoid the pitfalls of impulsive decision-making.

Monitoring and Re-evaluating Your Investments Regularly

Staying Informed and Making Informed Decisions

Regular monitoring of your investments allows you to stay informed about the performance of your portfolio and make informed decisions that support your long-term financial objectives. This process also enables you to identify new opportunities and trends that may impact your portfolio, such as new investment options or changes in market conditions.

Adapting to Changing Market Conditions

Re-evaluating your investments regularly helps you stay ahead of potential risks and take proactive steps to mitigate them. By assessing how new developments may affect your portfolio, you can make adjustments as needed to maintain diversification and ensure your investments remain aligned with your goals.

Positioning for Long-term Success

By staying proactive in monitoring and re-evaluating your investments regularly, you can position yourself for long-term success while adapting to changing market conditions effectively. This ongoing process enables you to maintain a successful investment portfolio that supports your financial goals and risk tolerance.

Staying Informed About Market Trends and Economic News

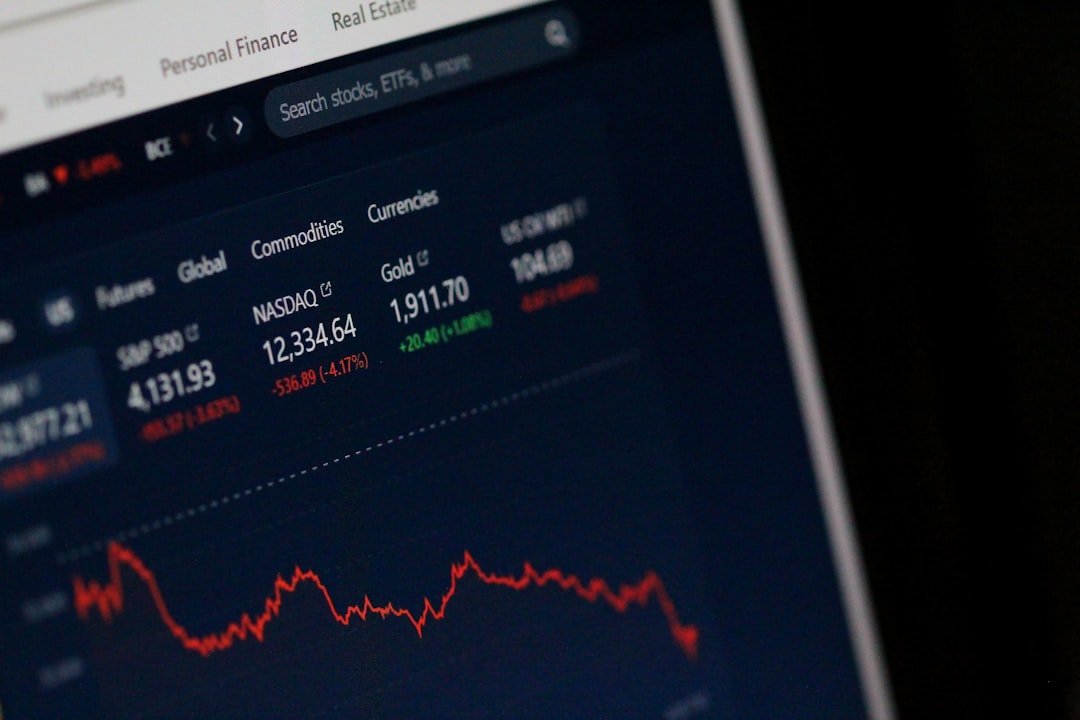

Staying informed about market trends and economic news is crucial for making informed investment decisions. By staying abreast of current events and economic developments, you can gain valuable insights into how they may impact different asset classes and industries. This can help you make informed decisions about where to allocate your investments based on changing market conditions.

Additionally, staying informed about market trends and economic news can also help you identify potential risks and opportunities that may affect your portfolio. Furthermore, staying informed about market trends and economic news can also help you stay ahead of potential risks and take proactive steps to mitigate them. For example, by staying informed about geopolitical events or regulatory changes that may impact specific industries or markets, you can make adjustments to your portfolio as needed to manage risk effectively.

Additionally, staying informed about market trends and economic news can also help you identify new investment opportunities that align with your financial goals and risk tolerance. By staying proactive in staying informed about market trends and economic news, you can make informed decisions that support your long-term financial objectives while managing risk effectively. In conclusion, building a successful investment portfolio requires careful planning, research, patience, and discipline.

By setting clear financial goals, diversifying your investment portfolio, researching and understanding investment options, seeking professional financial advice, being patient and avoiding impulsive decisions, monitoring and re-evaluating your investments regularly, and staying informed about market trends and economic news, you can position yourself for long-term success while managing risk effectively. With a well-thought-out investment strategy tailored to meet your specific needs and objectives, you can achieve your financial goals while navigating changing market conditions with confidence.

Check out this fascinating article on the world’s oldest libraries and learn about the rich history and cultural significance of these incredible institutions. It’s a great read for anyone interested in history and literature, and it’s sure to inspire a sense of awe and wonder.

FAQs

What is MSN Money?

MSN Money is a financial website that provides news, analysis, and tools for personal finance, investing, and business.

What kind of information does MSN Money provide?

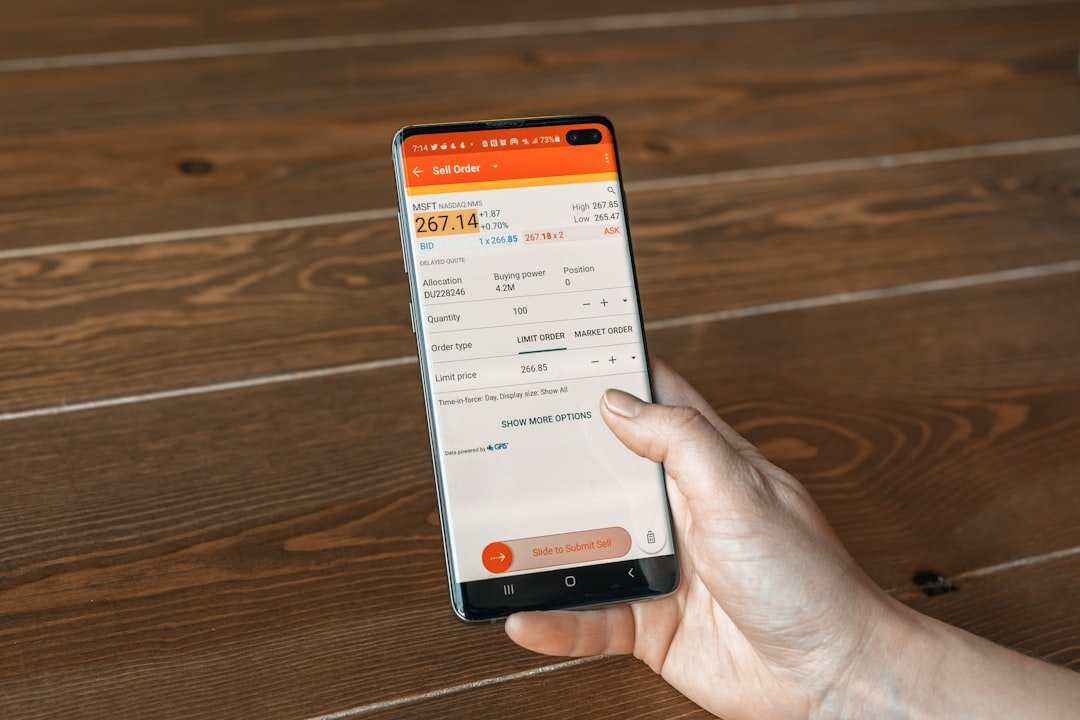

MSN Money provides information on stock quotes, market news, personal finance advice, and tools for managing investments and tracking financial goals.

Is MSN Money a reliable source for financial information?

MSN Money is a reputable source for financial information, as it is affiliated with Microsoft and partners with reputable financial news outlets.

Can I use MSN Money to track my investments?

Yes, MSN Money offers tools for tracking investments, including stock quotes, portfolio management, and market analysis.

Is MSN Money free to use?

Yes, MSN Money is free to use and does not require a subscription for access to its financial news and tools.

Does MSN Money offer financial advice?

Yes, MSN Money provides personal finance advice and articles on topics such as budgeting, saving, investing, and retirement planning. However, it is important to consult with a financial advisor for personalized advice.