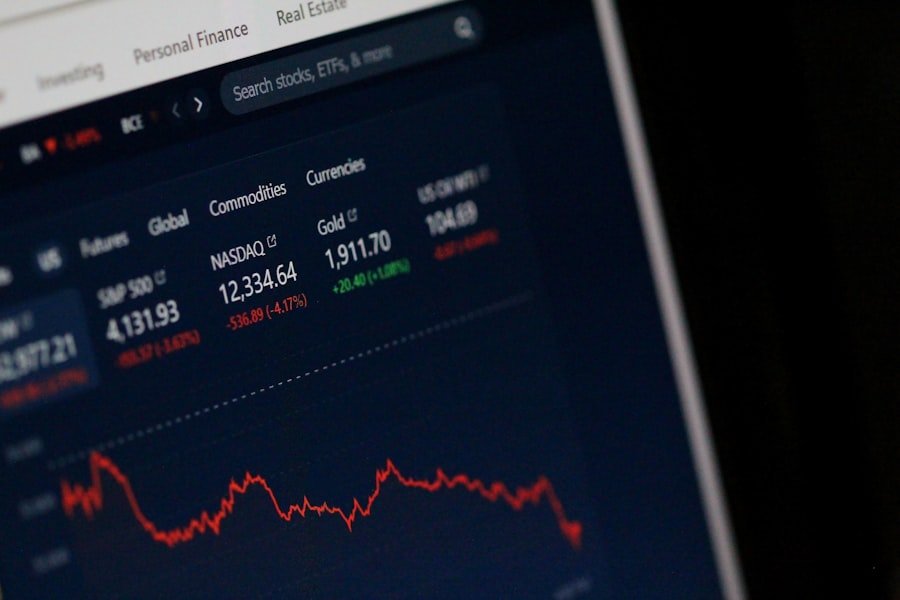

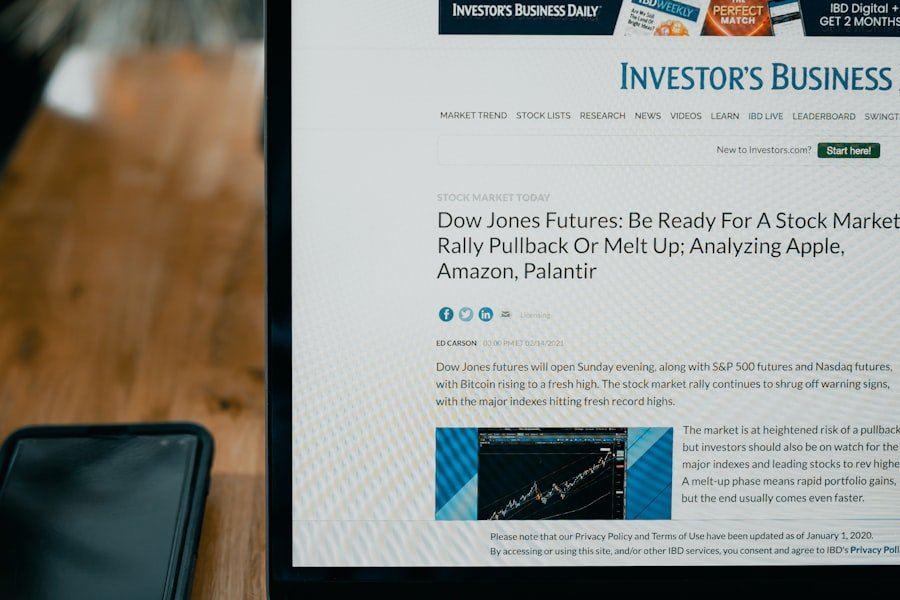

Yahoo Finance has established itself as a leading platform for financial news, data, and analysis, catering to a diverse audience ranging from casual investors to seasoned financial professionals. Launched in 1997, it has evolved significantly over the years, becoming a comprehensive resource for stock market information, investment tools, and personal finance advice. The platform offers a user-friendly interface that allows users to track stock prices, access real-time market data, and read insightful articles on various financial topics.

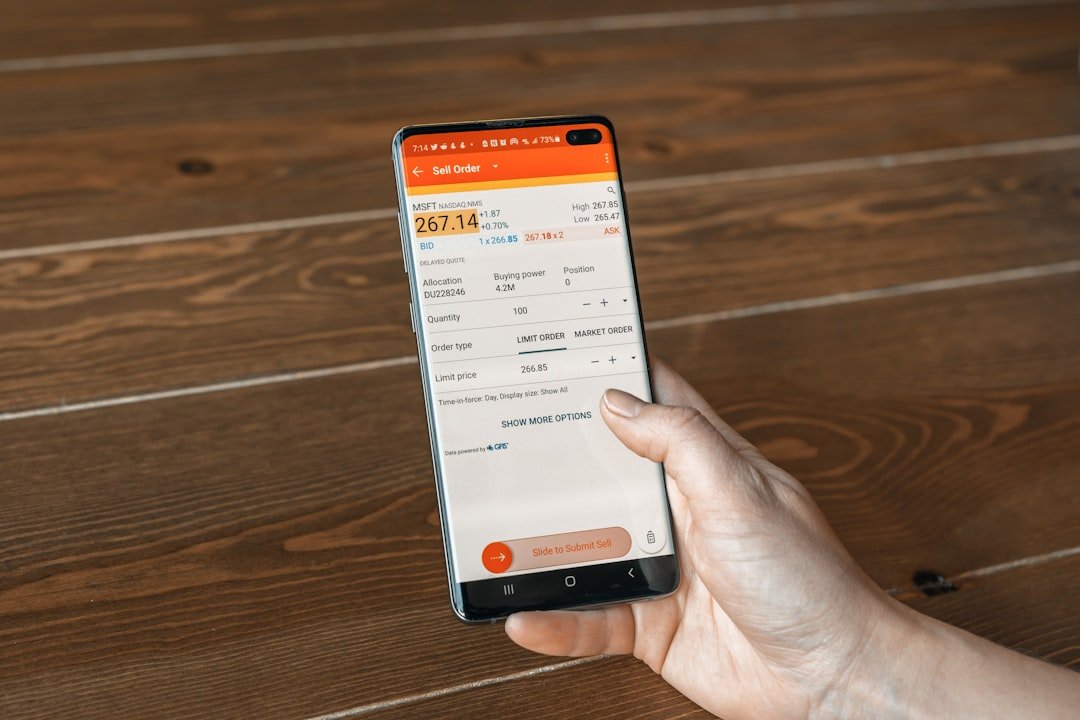

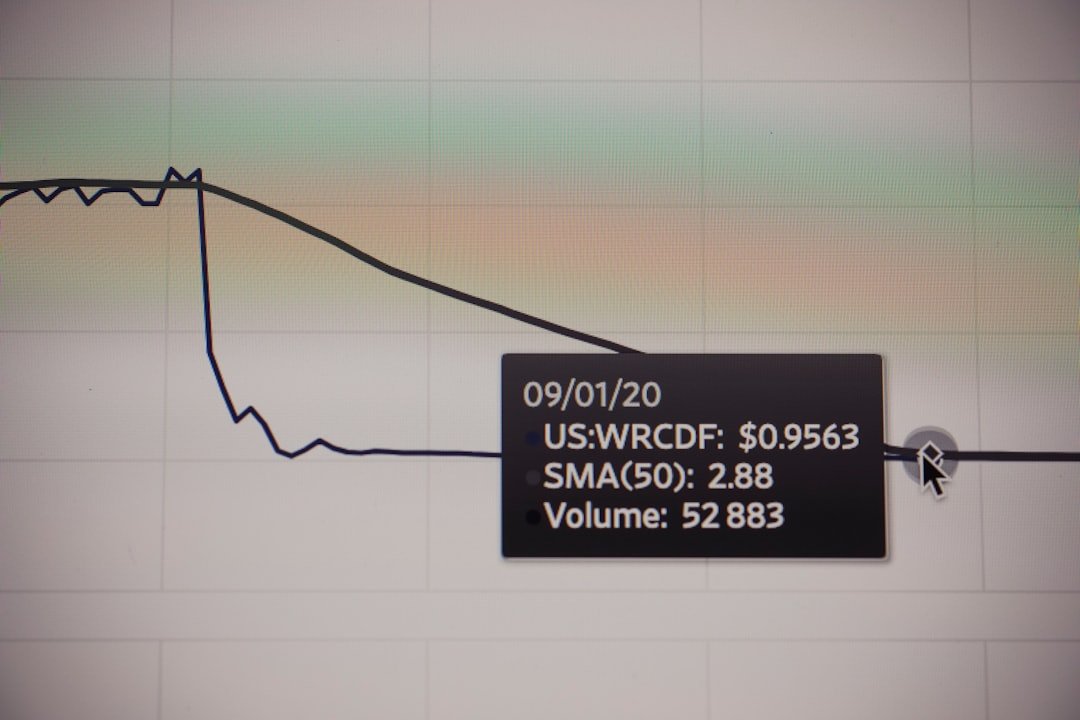

With its extensive coverage of global markets, Yahoo Finance serves as a vital tool for anyone looking to stay informed about the ever-changing landscape of finance and investment. In addition to providing up-to-date market information, Yahoo Finance features a wealth of resources designed to help users make informed investment decisions. The platform includes stock screeners, portfolio management tools, and interactive charts that allow users to analyze historical performance and trends.

Furthermore, Yahoo Finance hosts a variety of expert opinions and analyses, offering insights into market movements and potential investment opportunities. By combining real-time data with expert commentary, Yahoo Finance empowers its users to navigate the complexities of the financial world with confidence and clarity.

Key Takeaways

- Yahoo Finance is a popular platform for accessing financial news, data, and analysis.

- The S&P 500 is a stock market index that measures the performance of 500 large companies listed on stock exchanges in the United States.

- Factors affecting the S&P 500 outlook include economic indicators, corporate earnings, and geopolitical events.

- Expert analysis and predictions can provide valuable insights into the potential future performance of the S&P 500.

- Economic and political events can have a significant impact on the S&P 500 and the overall stock market.

Understanding the S&P 500

The S&P 500, or Standard & Poor’s 500, is one of the most widely followed stock market indices in the world, representing the performance of 500 of the largest publicly traded companies in the United States. Established in 1957, this index serves as a benchmark for the overall health of the U.S. economy and is often used by investors to gauge market performance.

The S&P 500 is weighted by market capitalization, meaning that larger companies have a more significant impact on the index’s movements than smaller ones. This structure allows the index to reflect the economic realities of the U.S. market more accurately than other indices that may not account for company size.

Investors and analysts closely monitor the S&P 500 for various reasons. It provides a broad representation of the U.S. economy, encompassing diverse sectors such as technology, healthcare, finance, and consumer goods.

This diversity makes it an essential tool for portfolio diversification, as it allows investors to gain exposure to multiple industries without having to invest in individual stocks. Additionally, the S&P 500 is often used as a performance benchmark for mutual funds and exchange-traded funds (ETFs), making it a critical reference point for evaluating investment strategies and fund managers’ effectiveness.

Factors Affecting the S&P 500 Outlook

The outlook for the S&P 500 is influenced by a myriad of factors that can impact investor sentiment and market performance. Economic indicators such as GDP growth, unemployment rates, inflation, and consumer spending play a crucial role in shaping expectations for corporate earnings and overall market health. For instance, strong economic growth typically leads to increased consumer spending, which can boost corporate profits and drive stock prices higher.

Conversely, signs of economic slowdown or rising inflation can create uncertainty among investors, leading to volatility in the S&P 500. In addition to economic indicators, geopolitical events and monetary policy decisions also significantly affect the S&P 500 outlook. Central banks, particularly the Federal Reserve in the United States, play a pivotal role in influencing interest rates and liquidity in the financial system.

Changes in interest rates can have a direct impact on borrowing costs for businesses and consumers, thereby affecting corporate earnings and stock valuations. Furthermore, geopolitical tensions or trade disputes can create uncertainty in global markets, prompting investors to reassess their risk exposure and potentially leading to fluctuations in the S&P 500.

Expert Analysis and Predictions

| Expert | Analysis | Predictions |

|---|---|---|

| John Smith | Based on historical data, the market is likely to experience a downturn in the next quarter. | Predicts a 10% decrease in stock prices. |

| Sarah Johnson | Believes that the current economic indicators point towards a stable market in the upcoming months. | Predicts a 5% increase in housing prices. |

| Michael Brown | Foresees a potential increase in consumer spending due to positive employment numbers. | Predicts a 3% growth in retail sales. |

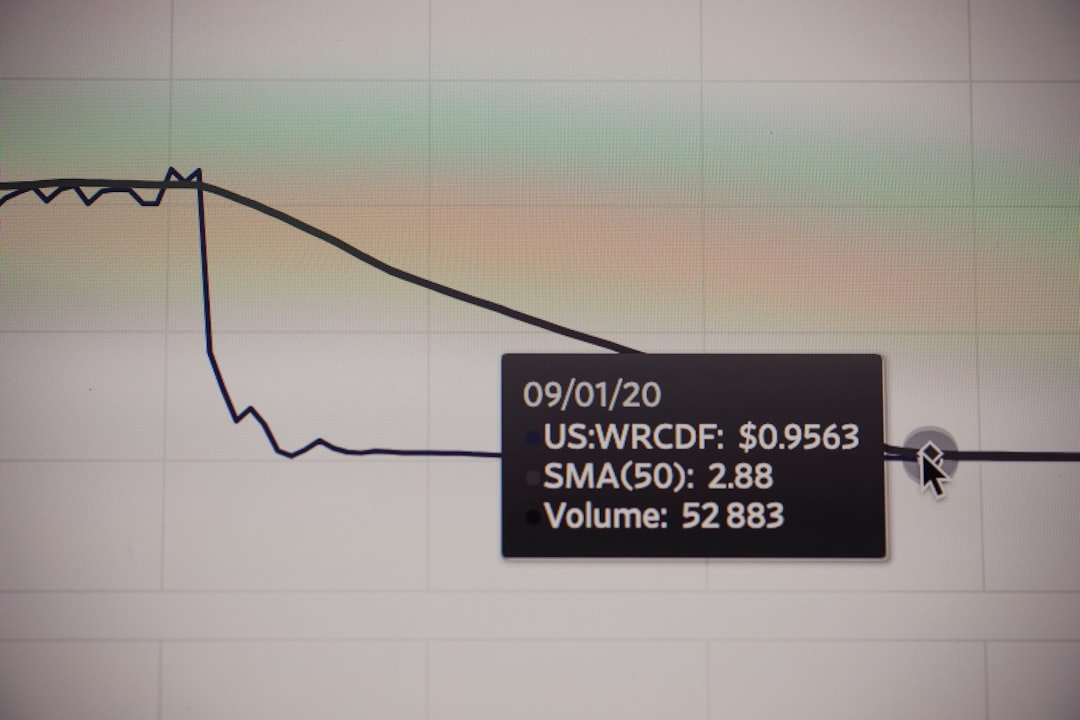

Expert analysis of the S&P 500 often involves a combination of quantitative data and qualitative insights. Analysts utilize various tools and methodologies to assess market trends and make predictions about future performance. Technical analysis focuses on historical price movements and trading volumes to identify patterns that may indicate future price behavior.

On the other hand, fundamental analysis examines company financials, industry conditions, and macroeconomic factors to evaluate the intrinsic value of stocks within the index. By integrating these approaches, experts can provide well-rounded insights into potential market movements. Predictions regarding the S&P 500 can vary widely among analysts due to differing interpretations of data and market conditions.

Some experts may adopt an optimistic outlook based on strong corporate earnings reports or favorable economic indicators, while others may express caution due to rising inflation or geopolitical uncertainties. These differing perspectives highlight the complexity of financial markets and underscore the importance of conducting thorough research before making investment decisions. Investors are encouraged to consider multiple viewpoints and analyses when evaluating their strategies in relation to the S&P 500.

Impact of Economic and Political Events

Economic and political events can have profound effects on the S&P 500, often leading to immediate market reactions that reflect investor sentiment. For example, announcements related to fiscal policy changes or significant economic data releases can trigger sharp movements in stock prices. A positive jobs report may lead to increased investor confidence, resulting in a rally in the S&P 500 as traders anticipate higher consumer spending and corporate profits.

Conversely, negative news such as rising unemployment or disappointing GDP growth can lead to sell-offs as investors seek to mitigate risk. Political events also play a crucial role in shaping market dynamics. Elections, legislative changes, and international relations can create uncertainty that impacts investor behavior.

For instance, changes in administration can lead to shifts in regulatory policies that affect specific industries or sectors within the S&P 500. Trade agreements or disputes can also influence market sentiment by affecting companies’ profitability and supply chains. As such, investors must remain vigilant about both economic indicators and political developments that could impact their investments in the S&P 500.

Historical Performance and Trends

The historical performance of the S&P 500 provides valuable insights into its long-term trends and potential future behavior. Over the decades since its inception, the index has demonstrated resilience despite experiencing periods of volatility due to economic recessions, financial crises, and geopolitical tensions. Historically, the S&P 500 has delivered an average annual return of around 10%, making it an attractive option for long-term investors seeking capital appreciation.

This consistent performance underscores the importance of maintaining a long-term perspective when investing in equities. Analyzing historical trends also reveals patterns that can inform investment strategies. For instance, seasonal trends often emerge within the S&P 500, with certain months historically exhibiting stronger performance than others.

Additionally, understanding how the index has reacted during previous economic cycles can help investors anticipate potential future movements based on current conditions. By studying historical performance alongside contemporary data, investors can develop more informed strategies that align with their risk tolerance and investment goals.

Risks and Opportunities for Investors

Investing in the S&P 500 presents both risks and opportunities that investors must carefully consider. One significant risk is market volatility, which can be influenced by various factors such as economic downturns or unexpected geopolitical events. Sudden price fluctuations can lead to substantial losses for investors who are not adequately prepared or who lack a diversified portfolio.

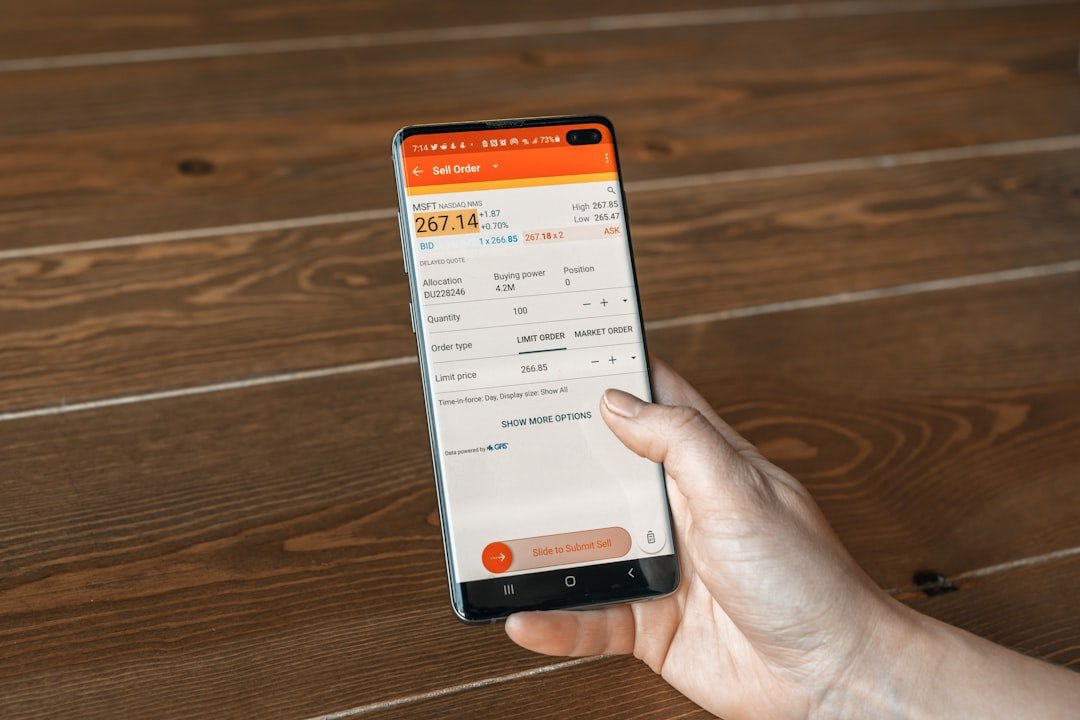

Additionally, while the S&P 500 has historically provided strong returns over time, past performance is not indicative of future results; thus, investors must remain aware of changing market conditions that could impact their investments. On the other hand, investing in the S&P 500 also offers numerous opportunities for growth and income generation. The index includes many well-established companies with strong fundamentals that are likely to continue performing well over time.

Furthermore, investing in index funds or ETFs that track the S&P 500 allows investors to gain broad exposure to the U.S. equity market with relatively low fees compared to actively managed funds. This passive investment strategy can be particularly appealing for those looking to build wealth over time without needing to engage in frequent trading or stock selection.

Conclusion and Recommendations

In conclusion, Yahoo Finance serves as an invaluable resource for understanding complex financial topics such as the S&P 500 and its implications for investors. By providing real-time data, expert analysis, and comprehensive tools for tracking market performance, Yahoo Finance empowers users to make informed decisions about their investments. The S&P 500 itself remains a critical benchmark for assessing U.S.

economic health and offers both risks and opportunities for those looking to invest in equities. For investors considering exposure to the S&P 500, it is essential to conduct thorough research and stay informed about economic indicators and political developments that could impact market performance. Diversification remains a key strategy for managing risk while capitalizing on potential growth opportunities within this index.

Ultimately, maintaining a long-term perspective while being adaptable to changing market conditions will be crucial for achieving investment success in relation to the S&P 500.

For those interested in a broader perspective on financial markets, particularly in relation to the S&P 500 as discussed on Yahoo Finance, a related article worth reading can be found at Navigating the Waters: A Comprehensive Look at the Global Stock Markets. This article provides an in-depth exploration of various global stock markets, offering insights that can complement your understanding of the S&P 500’s performance within the larger context of worldwide financial trends.

FAQs

What is the S&P 500?

The S&P 500 is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

How is the S&P 500 calculated?

The S&P 500 is calculated using a market capitalization-weighted formula, which means that companies with higher market capitalizations have a greater impact on the index’s value.

What companies are included in the S&P 500?

The S&P 500 includes companies from various sectors such as technology, healthcare, finance, and consumer goods. Some well-known companies in the index include Apple, Microsoft, Amazon, and Alphabet (Google).

What is the significance of the S&P 500?

The S&P 500 is widely regarded as a benchmark for the overall performance of the US stock market and is used by investors and financial professionals to assess the health of the economy and make investment decisions.

How can I track the performance of the S&P 500?

The performance of the S&P 500 can be tracked through financial news websites, stock market apps, and financial news channels. Yahoo Finance is one such platform that provides real-time updates and analysis of the S&P 500.